As a merchant, dealing with chargebacks is already challenging enough, but it becomes more complex once you dive deeper into the different processes for each card you accept. In this case, we’re going to talk about Discover and how its chargeback process, known as the discover dispute process, works.

Just like other networks, Discover has its own system established, such as timeframes, exemptions, and procedures. How will merchants protect themselves from unwanted disputes and win a reversal? In this guide, we’re going to take you through Discover’s chargeback process, why it happens in the first place, and what you can do as a merchant to win the dispute.

The Difference Between Discover Chargebacks From Other Card Brands

Generally speaking, Discover transactions work the same way as Visa or Mastercard, but there are some key differences that are worth mentioning.

Unlike Visa and Mastercard, Discover operates as both the credit card issuer and network. This dual role means that Discover handles all aspects of the transaction, including disputes and chargebacks, without involving a third party. As a result, the process can be more streamlined but also more stringent, as Discover has direct control over the rules and procedures governing chargebacks.

Why Do Discover Chargebacks Happen?

Fraudulent Transactions

Credit card fraud occurs when a customer claims that their card was used without their permission.

Product or Service Issues

There are times wherein a customer isn't satisfied with his/her purchase, thus leading to a dispute.

Authorization Issues

If a transaction is processed without the corresponding authorization code, it can also lead to a dispute.

Processing Errors

Mistakes that occur during the transaction, such as charging the wrong amount can result in a dispute.

The Discover Chargeback Process

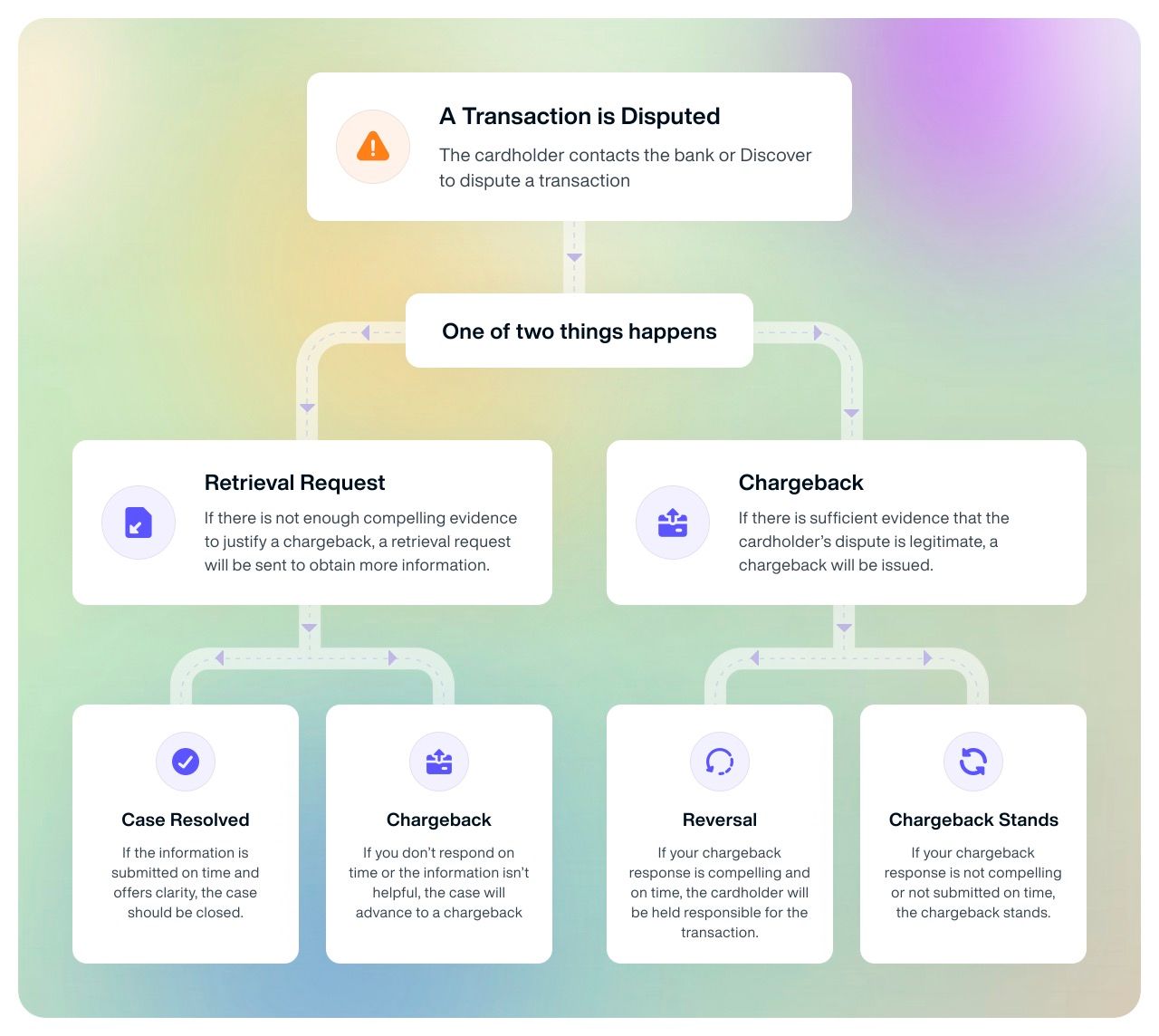

Discover has a slightly different chargeback process compared to Visa and Mastercard. Below is an easy chart you can view to see how the flow works.

When a cardholder disputes a charge, Discover reviews the transaction details to determine if the claim is valid. Discover decides the validity of the dispute by investigating the transaction and considering all relevant information.

If the claim is valid, Discover issues a chargeback. To gather more details, Discover may send a Ticket Retrieval Request (TRR) to the merchant. A TRR is Discover’s way of asking for more information about the transaction. Since Discover acts as both the issuer and network, they need to have extensive transaction data at their disposal.

These requests are crucial; if the merchant doesn’t respond, the claim escalates to a chargeback, resulting in additional fees.

The Different Discover Chargeback Reason Codes

Discover has its own system of categorizing chargebacks by using specific reason codes. Each code corresponds to a different cause for the dispute. These codes help both the cardholder and the merchant identify the exact nature of the issue.

Some common Discover chargeback reason codes include:

- Fraudulent Transaction (Reason Code UA01): This code is used when a cardholder claims that their card was used without their authorization. Fraudulent transactions are a leading cause of chargebacks, and this reason code triggers a thorough fraud investigation by Discover.

- Goods or Services Not Received (Reason Code RM01): This code applies when a customer claims that they never received the goods or services they paid for. It can also be used if the delivery was significantly delayed.

- Merchandise or Service Not as Described (Reason Code RM02): If a customer argues that the product or service received is not as described or advertised, this code is applied. This can include discrepancies in quality, features, or functionality.

- Credit Not Processed (Reason Code AP01): When a customer returns merchandise or cancels a service and does not receive the promised refund, this reason code is used. It often arises from misunderstandings or errors in processing refunds.

- Duplicate Processing (Reason Code DP01): This code is issued when a transaction is processed more than once, leading to duplicate charges on the customer’s account.

How Long is the Time Limit for a Discover Dispute?

Merchants dealing with Discover chargebacks must be aware of two key time limits: filing a chargeback and responding to a dispute. Cardholders with a Discover credit card have 120 days from the transaction date to initiate a chargeback, though Discover may consider late claims. Once a dispute is filed, merchants have five days to respond to a ticket retrieval request and 20 days to provide further documentation for any appeals.

If a chargeback is issued, merchants have 20 days to submit additional evidence through the representment process—a shorter timeframe than other networks allow. For disputes requiring arbitration, the deadline is 30 days. Actual time limits may be shorter due to internal deadlines from acquirers, processors, and issuers, making prompt action crucial to avoid losing a chargeback.

The Consequences of Too Many Discover Chargebacks

Garnering excessive Discover chargebacks can generate serious consequences, and it’s important for every merchant to be aware of these. A shop with high chargeback ratios can lead to an increase in processing fees and penalties.

In more severe cases, persistent chargeback issues can result in the termination of the merchant’s Discover account with their acquiring bank or payment processor. Besides the financial implications, a high chargeback rate can also damage the reputation of the merchant, making it more challenging to establish trust with new customers and financial institutions.

It’s every merchant’s responsibility to monitor their chargeback ratios closely and implement preventative measures to avoid disputes whenever possible.

The Necessity of Discover's Chargeback Tools

While chargebacks are designed to protect consumers, the system can often feel tilted in favor of the cardholder. However, Discover provides a suite of tools to help merchants manage and prevent chargebacks effectively, especially for Discover Card transactions.

The Discover Network Dispute System (DNDS) is a key resource in dispute resolution, allowing authorized users to access transaction and cardholder details and upload evidence to contest chargebacks. Besides DNDS, Discover offers other handy fraud prevention tools, including the $0 Fraud Liability Guarantee for Discover Cardholders.

Discover ProtectBuy

This is Discover's version of 3-D Secure, verifying the cardholder's identity at the time of purchase through real-time, single-use passwords for high-risk transactions.

Discover Verify+

This tool identifies high-risk transactions before fulfillment, comparing transaction data with Discover's records to prevent fraud and reduce the abandonment of shopping carts.

Fraud Alerts Standard

This is a free platform that provides early warnings of fraudulent transactions, allowing merchants to cancel suspicious orders immediately. It also comes in a premium version which gives you access to more features.

How to Win the Disputed Transaction as a Merchant

To win a chargeback dispute as a merchant, here are important things you need to keep in mind:

Keep Detailed Records

Maintaining comprehensive records of all transactions is crucial. This includes keeping receipts, invoices, and any communication with the customer. Make sure to include the account number in your transaction records, as it is essential for verification and reference during disputes.

Keep Detailed Records

Maintain comprehensive records of all transactions, including receipts, order confirmations, and communication with customers. This is also one way to keep all your transactions organized whether or not there's a dispute happening.

Provide Clear Evidence

Submit clear and relevant evidence that directly addresses the dispute’s claims. This could include proof of delivery, signed agreements, or any documentation that supports the transaction’s validity.

Respond on Time

It's your duty to submit timely responses to dispute notifications as these are very important in preventing delays which can lead to automatic losses.

The Strategy to Preventing Discover Chargebacks

Even though there’s this possibility of winning a reversal on a Discover chargeback, prevention is always better than cure. In this case, the best plan of action is by ensuring they don’t happen in the first place.

Having clear communication with your customers is a great chargeback prevention strategy. Merchants should always have their customer service contact information noticeably displayed and accessed easily from different parts of their websites.

To avoid any misunderstandings or false expectations, your return & exchange policy, as well as other terms of service must be displayed before completing the checkout process.

Remember that security code (CVV) at the back of a card? Those numbers are important to authorize the cardholder’s transaction. Make sure that the code is always requested during checkout and use Verify+ and Automated Address Verification (Discover’s AVS) to validate cardholder details.

Lastly, process refunds immediately and promptly inform customers about when they can expect their credit.

Discover Chargeback Prevention Made Easy with Chargeblast

With so many transactions happening day-to-day, chargebacks are inevitable. Sign up with Chargeblast to get chargeback alerts and minimize chargeback rates up to 0%, including for Discover credit cards, and get real-time alerts whenever a customer disputes a transaction due to recurring payments.