Buy Now, Pay Later (BNPL) services have changed how people shop, making big purchases feel more manageable. Over 41% of adults in the US have used Buy Now, Pay Later services within the past 12 months.

Klarna and Affirm are two of the biggest names in this space, but how do they compare to one another? If you’re deciding between the two, we’re here to break it down and make it easier for you to decide which platform suits your business needs the best.

What is Klarna?

Klarna is a top Buy Now, Pay Later provider that allows consumers to split payments into installments rather than paying in full at checkout. Founded in Sweden in 2005, Klarna first gained traction by streamlining invoice payments for eCommerce. The company later introduced the BNPL model, ultimately accelerating the company’s growth.

Today, Klarna has over 575,000 global merchant partners and roughly 150 million users across 45 countries. Celebrities like A$AP Rocky and Shaquille O’Neal have also worked closely with the company. In the U.S. alone, Klarna serves around 34 million customers and handles about 2 million transactions daily. They also recently integrated with Apple Pay in the US and UK.

What are Klarna’s Key Features?

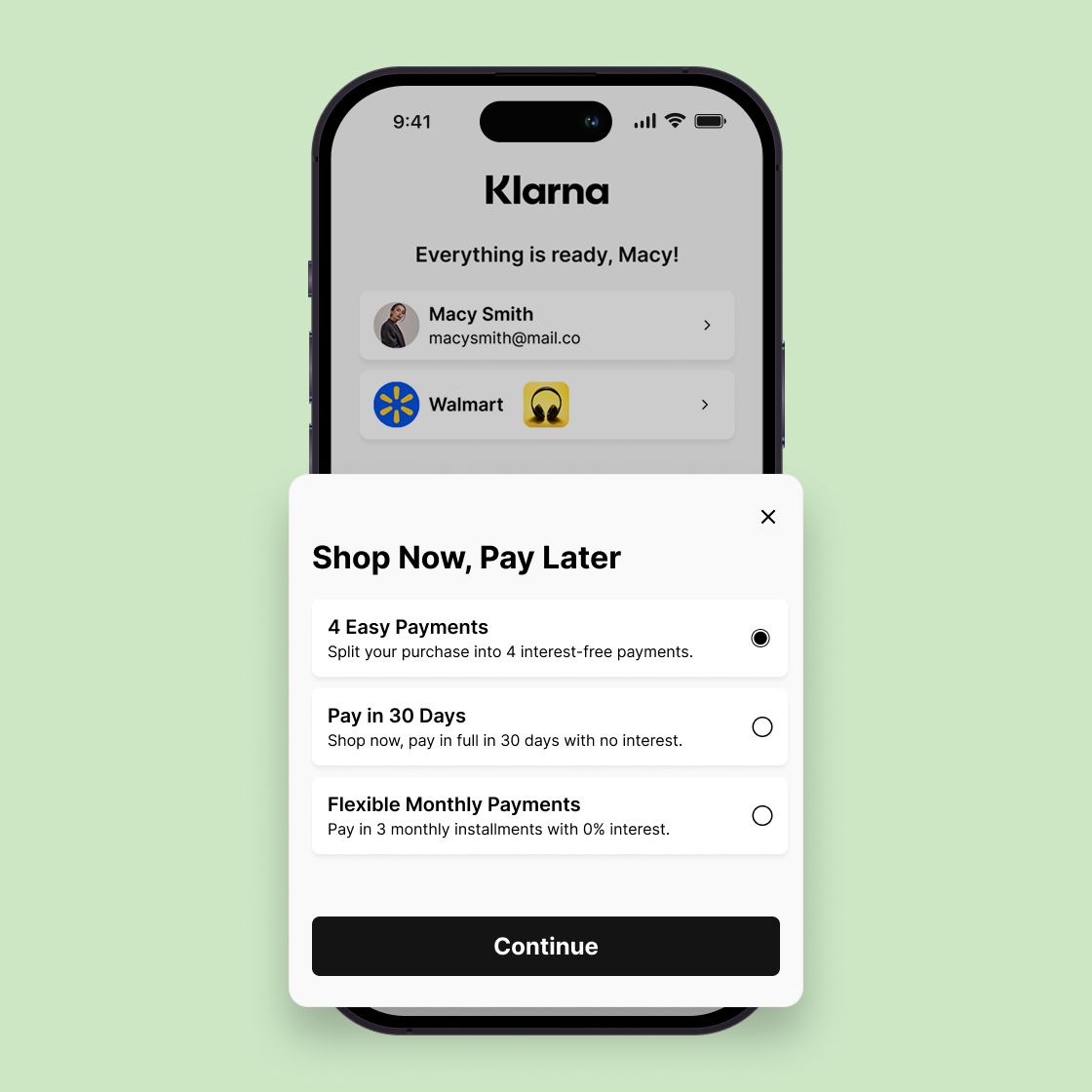

Klarna offers multiple payment options that cater to different shopping preferences. Users can manage purchases, track payments, and access customer support through Klarna’s app. Here are some of its standout features:

- Pay in 4: Shoppers split their total into four interest-free installments, with payments due every two weeks.

- Pay in 30: Customers can buy now and pay the full amount within 30 days.

- Long-term financing: Klarna, in partnership with WebBank, offers financing for large purchases, with repayment periods from 6 to 36 months and interest rates starting at 7.99%.

- Klarna Card: A virtual card lets users make installments at any store, even if Klarna isn’t directly integrated yet.

Klarna’s open banking (Klarna Kosma) helps banks, fintech companies, and merchants create better financial products. Businesses can use Klarna’s system to build new payment solutions that give customers more flexibility. Around 15,000 partners already use Klarna’s open banking API to improve their services.

For merchants, Klarna makes it simple to offer buy now, pay later options at checkout. Businesses can pick payment plans that fit their customers’ needs, create a custom setup, or connect Klarna with platforms like Shopify, WooCommerce, and Magento.

How is Klarna’s Pricing?

Klarna makes money by charging merchants and collecting interest on long-term financing. While it gives customers flexible payment options, businesses should consider the costs of offering Klarna at checkout. Here’s a breakdown of how Klarna's pricing varies:

- Merchant fees: Klarna charges merchants a flat fee of around 5% per transaction, which is higher than what credit card processors like Stripe or Shopify Payments typically charge.

- Transaction fees: Klarna’s Pay Later and Financing options come with fees between 3.29% + $0.30 and 5.99% + $0.30 per transaction, depending on the service and location.

- Chargeback fees: If a customer disputes a charge and wins, the merchant pays a $15 fee per dispute.

- Buyer fees: Some purchases made through Klarna’s app come with a $2.12 service fee, and international transactions may include currency conversion fees.

Benefits of Using Klarna

Klarna has built a strong reputation as a BNPL provider because of its convenience and flexibility. Here’s why so many businesses and consumers use it:

- Global reach: Klarna serves 150 million customers and works with 575,000 merchants in 45 countries.

- Lower cart abandonment: Klarna’s flexible payment options make it more likely for shoppers to complete purchases instead of leaving items in their carts.

- Multiple payment options: Customers can choose between Pay in 4, Pay in 30, or long-term financing.

- No interest on short-term plans: Pay in 4 and Pay in 30 have zero interest, making them more appealing than credit cards.

- Merchant protection: Klarna covers the risk of non-paying customers, so businesses don’t lose money if someone defaults.

- Easy setup: Klarna integrates with major eCommerce platforms, making it simple for merchants to add it as a payment option.

- Fraud prevention: Advanced security features help protect businesses from fraud.

- Soft credit checks: Klarna uses soft credit inquiries, which means most shoppers are approved without affecting their credit scores.

Drawbacks of Using Klarna

Klarna makes shopping more flexible for customers, but just like any other platform, it comes with potential downsides for both merchants and buyers. Here are some reported drawbacks of Klarna:

- Higher merchant fees: Klarna charges a percentage of the total transaction amount, which can be more expensive than traditional payment processors.

- Late fees for missed payments: Customers who miss a repayment deadline face a $7 late fee after 10 days, though Klarna caps total late fees at 25% of the purchase amount.

- Credit and collection risks: If a customer defaults on payments, Klarna may send the debt to a collection agency and report it to credit bureaus, potentially damaging their credit score.

- Fraud concerns: Klarna’s internal approval system replaces traditional credit checks, which some experts argue makes it more vulnerable to fraud.

What is Affirm?

Affirm is another notable buy now, pay later (BNPL) service that is dominating the industry. Founded in 2012 by PayPal co-founder Max Levchin, Affirm aims to provide a more transparent alternative to credit cards. It went public in 2021 and now has millions of users across the U.S. and Canada.

Compared to traditional credit cards, Affirm offers fixed payment plans with clear terms upfront. Shoppers know exactly what they’ll pay before completing a purchase, which erases their worries about hidden fees or surprise interest charges. They can shop online or in stores using the Affirm app, which generates virtual cards accepted at most retailers that take Visa.

The Key Features of Affirm

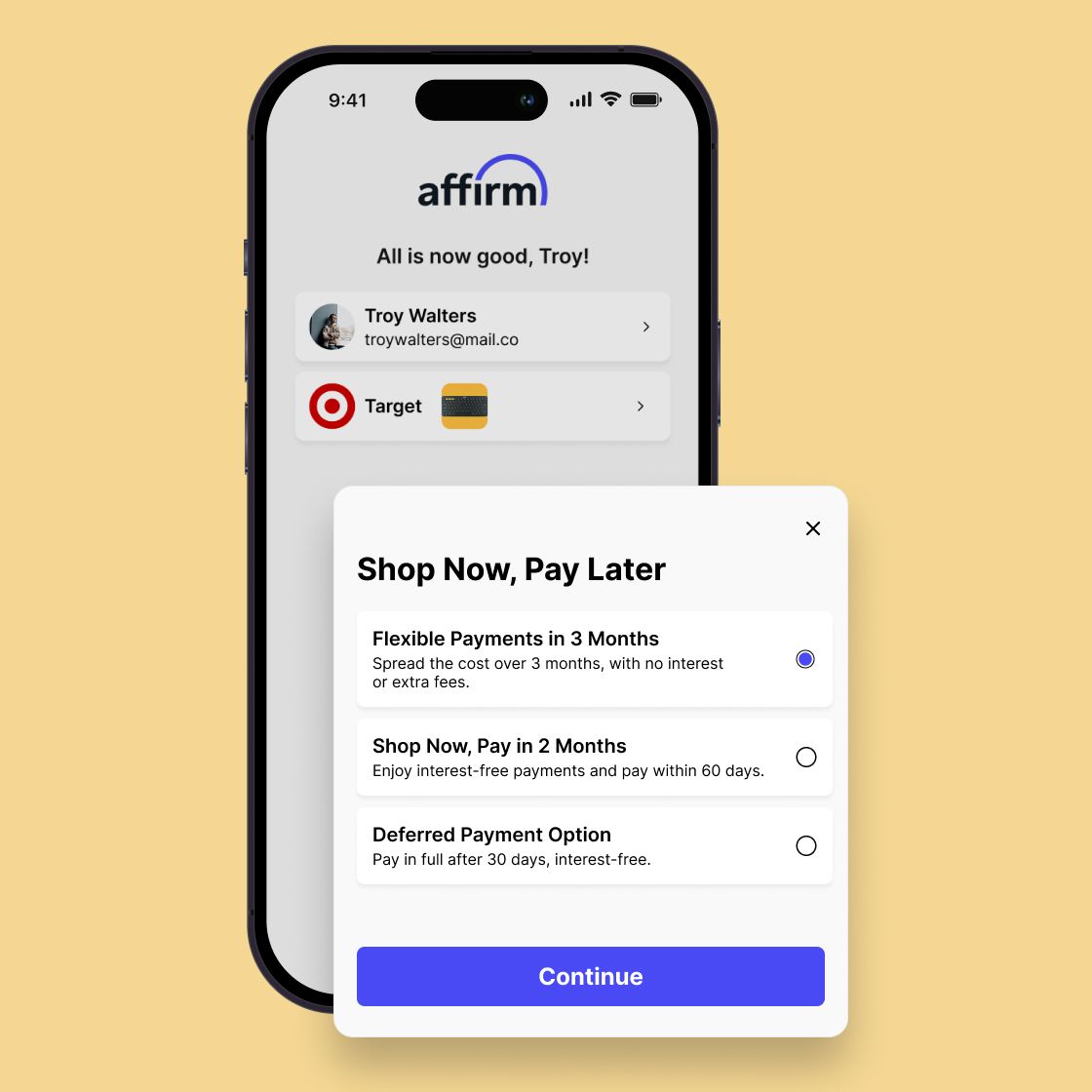

Affirm focuses entirely on financing purchases, making them stand out from other BNPL services that also offer bill payments or money transfers. Its highlighted features include:

- No fees: Affirm doesn’t charge late fees, annual fees, or prepayment penalties.

- Pay in 4: Shoppers can split payments into four equal installments over six weeks with zero interest. This option is available for purchases between $50 and $1,000.

- Affirm Card: Users can pay in full like a debit card or choose flexible financing directly through the Affirm app.

- Longer financing options: For larger purchases, Affirm offers loan terms between 3 and 48 months, with interest rates ranging from 0% to 30%, depending on the borrower's creditworthiness and retailer.

- Custom credit limits: Affirm assigns spending limits based on a shopper’s financial profile, with a maximum of $17,500.

Having partnered with thousands of retailers in a plethora of industries, shoppers can easily use Affirm online, through the app, or use the virtual card when buying in-store.

Affirm’s Pricing

Affirm makes money by charging merchants a percentage of each transaction. While shoppers don’t pay fees, some financing options include interest charges.

- Interest rates: APRs range from 0% to 30%, depending on a user’s credit profile and the retailer’s financing program. In some cases, the cost of borrowing through Affirm can be higher than using a traditional credit card, which has an average APR of 19.07% (Federal Reserve).

- Merchant fees: Businesses pay around 6% + $0.30 per transaction, a rate that varies based on factors like risk, business size, and financing options offered.

- Additional costs: Affirm also generates revenue through interchange fees and loan servicing fees charged to third-party investors.

Affirm also offers custom pricing plans for larger enterprises, allowing them to tailor their BNPL offerings to their business model.

Advantages of Using Affirm

Affirm’s financing options can be handy for merchants selling high-ticket items over $500 and businesses targeting younger consumers who prefer flexible payment plans. Here’s why they stand out:

- Easy setup process: The registration process is straightforward for both merchants and shoppers.

- Soft credit checks: Affirm assesses creditworthiness without impacting a user’s credit score.

- Higher conversions: Offering Affirm can reduce cart abandonment since customers prefer more flexibility.

- Interest-free payments: The Pay in 4 option has no interest, appealing to cost-conscious shoppers.

- No hidden fees: Shoppers won’t be charged for late payments, prepayment, account setup, or closure.

- Broad integration: Affirm works with major retailers, making it a convenient financing option for many purchases.

Disadvantages of Using Affirm

Despite the benefits, Affirm has received criticism for its features. Here are some drawbacks to consider:

- Higher interest rates on long-term loans: Some financing plans have interest rates up to 36%, which can be more expensive than traditional credit cards.

- Credit risks for missed payments: While Affirm doesn’t charge late fees, accounts overdue for 120 days can be sent to collections, which may hurt a shopper’s credit score.

- Merchant fees: Businesses pay a transaction fee on every sale, which can cut into profit margins.

- Refund policies: If a customer requests a refund, the merchant must still cover Affirm’s transaction fees, similar to credit card processing costs.

Klarna vs. Affirm: Comparing the Two

Payment Terms

Klarna:

- Pay in 4 installments

- 30-day payment windows

- Long-term financing options

Affirm:

- Pay in 2 plan

- Pay in 4 installments

- 30-day payment options

- Loans extending from 3 to 48 months

Fees and Interest Rates

Klarna:

- Primarily interest-free for short-term plans

- Interest rates ranging from 7.99% to 29.99% for longer financing

- $7 fee for missed payments after 10 days

- Potential credit bureau reporting for late payments

Affirm:

- 0% APR for Pay in 4 loans

- Long-term financing up to 36% APR

- No late payment fees

- No compound interest on late payments

Keep in mind that both platforms charge a $15 chargeback fee.

Accessibility

With 43.9 million users and a robust 9% annual growth, Klarna is proving itself as a versatile financial tool. Affirm takes a more focused approach, concentrating on U.S. and Canadian markets. Serving 18.7 million users and supporting 303,000 active merchants, it carefully selects its eCommerce partnerships, avoiding high-risk verticals.

Both platforms share the same user requirements:

- At least 18 years old

- Lives in US territories, Canada, and Australia

- Valid payment method

- A positive credit history

- Can receive a text verification

Then, where do they differ? The approval rates. Klarna has a more flexible acceptance, in which a broader range of shoppers can apply. Affirm maintains a more selective screening process, which means fewer customers get the green light.

Target Audience

While both Klarna and Affirm appeal to a younger audience, there are some slight differences in the demographic that use each platform.

Klarna:

- 80% under 34 years old

- 60% women

- 40% men

Affirm:

- Millennials and Gen Z

- 53.86% female

- 46.14% male

By the numbers, Klarna serves 43.9 million users, growing 9% annually, while Affirm supports 18.7 million users with 303,000 active merchants.

Final Thoughts: Klarna vs. Affirm

Both Klarna and Affirm offer flexible payment options, but the decision between them comes down to the type of purchase you're making and how you plan to use the service. Let’s dive into when each service might be the best fit for you.

Why Choose Klarna?

- Subscriptions: Klarna makes it easy to manage subscription services with automatic renewals. The app saves your payment details for hassle-free, tokenized payments.

- On-demand purchases: Its integration with digital wallets makes it easy to complete one-click purchases with flexible payment options.

- Open banking: Klarna's ability to bypass card networks lets customers pay directly from their bank accounts, streamlining the checkout process.

- International merchants: Klarna offers more extensive global coverage compared to Affirm, making it a great option for businesses that operate internationally or want to reach a wider customer base.

When to Choose Affirm

- Large purchases: If you're looking to buy furniture or electronics, Affirm's financing plans are much more flexible and has clearer terms and low interest rates.

- Emergencies: Have medical bills or car repairs you suddenly have to pay? These costs can be divided into a more flexible scheme with Affirm's financing options.

- Local transactions: If your business has a U.S. or Canadian audience, Affirm makes transactions a lot smoother, especially if you have a good credit rating.

When deciding between the two, both Klarna and Affirm have great features that are beneficial for your business; depending on how you use it, as well as your goals.

Klarna works well for flexible, everyday payments, especially for international shoppers, while Affirm is better suited for larger purchases or emergency situations.

Why BNPL Merchants Need Chargeblast

Buy Now, Pay Later merchants know the pain of receiving chargebacks. That’s why Chargeblast is here to help! Our smart tech helps prevent disputes before they even happen, and this all works without you having to think twice about it.

It’s time to protect your profits. Let us handle your chargebacks for you. You can learn more about how it all works and get started here.