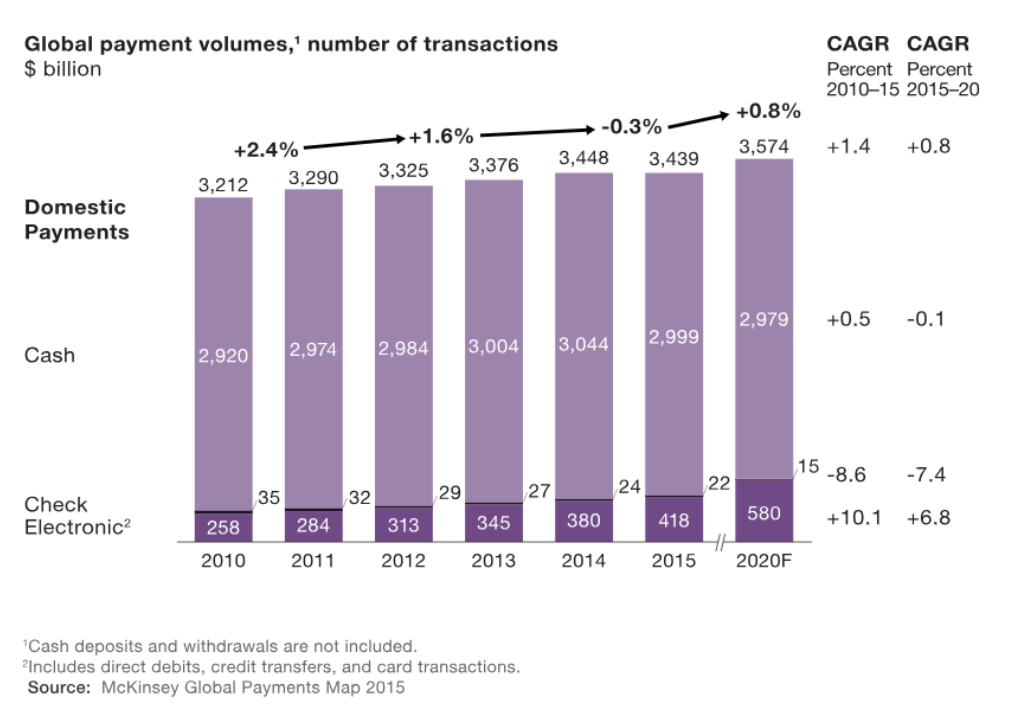

Card payment disputes between customers and merchants may occur infrequently, but their impact on bank-customer relationships cannot be underestimated. Building customer trust, ensuring the safety of deposits, and providing prompt and accurate dispute resolution are vital elements of these relationships. While disputes can cause frustration for customers and pose significant costs for banks, there is an opportunity for banks to strengthen their bond with customers by reframing disputes as a chance for relationship enhancement. This is especially crucial in an era where electronic payments are replacing cash and checks, leading to a surge in disputable transactions and fraud cases, and mounting operational costs.

Challenges in Dispute Resolution:

Banks face several obstacles when it comes to addressing the growing number of card disputes:

-

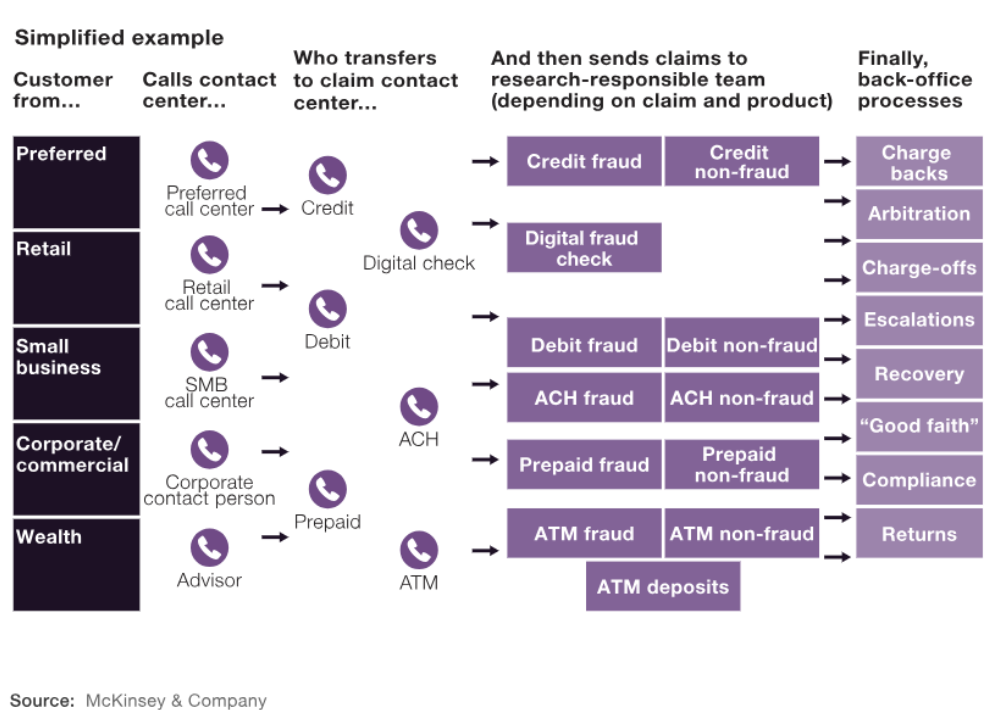

Complex operating models: Traditional structures lack a clear, end-to-end chain of responsibility for the disputes experience, resulting in disjointed customer interactions and delays in resolution.

-

Overprocessing of disputes: Banks process all disputes regardless of value, customer, or merchant history, leading to a rise in dispute volumes and increased pressure on teams to handle cases quickly.

-

Lengthy research process: Dispute processes often involve multiple IT systems, impeding efficiency and relying on third-party support for fraud research.

-

Ineffective quality assurance: Dispute review processes tend to prioritize regulatory compliance over overall accuracy, hindering the identification and rectification of incorrect decisions.

-

Inadequate performance management: Varied individual performance, limited use of metrics, and a lack of fact-based coaching contribute to disparities in productivity within dispute resolution teams.

-

Over-reliance on case-management systems: Implementations have yielded marginal improvements in resolution efficiency, and integrating various systems for streamlined resolution remains a challenge.

-

Increasing regulatory focus: Customer-protection regulations tighten dispute-resolution timelines, creating pressure to process cases quickly but leaving underlying issues unresolved.

Simpler, Smarter Dispute Processing:

To overcome these challenges, banks can leverage new insights, tools, and capabilities to transform their dispute-resolution processes. By adopting an integrated, next-generation operating model, banks can achieve significant improvements in customer experience, cost reduction, financial losses, and regulatory risk. The following imperatives should guide this transformation:

-

Digitize the dispute-resolution process: Simplify the dispute filing process for customers through mobile-friendly interfaces and streamline research by collecting upfront information from customers, reducing the need for repetitive questioning.

-

Redesign the process with lean principles: Reimagine the entire dispute process from scratch, categorize disputes based on complexity, and simplify research policies and requirements.

-

Apply advanced analytics: Utilize advanced analytics and machine learning to predict disputes and fraud, enabling real-time provisional credit decisions and efficient allocation of research capacity.

-

Employ intelligent process automation: Leverage intelligent process automation, including robotics, to reduce cycle times, enhance operational efficiency, and improve customer experience across various stages of dispute resolution.

-

Strengthen management systems: Adopt an end-to-end approach to dispute management, assign product owners responsible for customer experience, quality, and efficiency, and establish clear key performance indicators (KPIs) to focus on desired outcomes.

Maximizing Dispute Benefits:

Transforming the dispute-resolution process can yield significant benefits for banks:

-

Strengthening trust: Swift resolutions and provision of appropriate funds can turn negative experiences into loyalty-building moments, fostering a sense that the bank has the customer's back.

-

Cutting operating costs: Implementing the next-generation operating model can significantly reduce operating expenses, estimated to be around $3 billion annually for the top 15 US banks, leading to cost savings of 25 to 40 percent.

-

Improving quality: Streamlining and automating the process result in better decision-making, reducing the rate of incorrect dispute outcomes and enhancing overall quality.

Card payment disputes present an opportunity for banks to enhance customer relationships while optimizing costs. By embracing innovative tools and capabilities and reimagining the dispute-resolution process holistically, banks can provide a superior customer experience, reduce expenses, and improve decision quality. Overlooking this chance to build trust and loyalty is a missed opportunity, and banks must seize it to thrive in an evolving digital payment landscape.