Yes, you read that right. Just months after their last update, Visa released its latest Visa Acquirer Monitoring Program (VAMP) guidelines and it has merchants worried. To put it simply, processors will need to lower their chargeback tolerance by 30% while merchants will have half the resources to keep their chargeback rates within acceptable levels. You can read full and original release by Visa here.

How is the new VAMP ratio calculated?

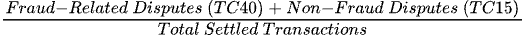

The VAMP ratio for both processors and merchants is reviewed on a monthly basis and calculated as:

It is important to remember that this calculation excludes any non-fraud disputes resolved through CDRN and RDR pre-dispute alerts. Because RDR is mandated through VROL, merchants have half of the equation covered. But what about fraud-related disputes?

According to the announcement, any deflected fraud-related disputes through real-time representment (i.e., Compelling Evidence 3.0) will be excluded from the VAMP calculations. However, real-time representment only deflects 15% of fraud-related disputes in practice. For many subscription merchants, where over 50% of chargebacks are fraud-related, this coverage is simply not enough to avoid fees, account suspension, and other penalties.

Lastly, according to Visa, the VAMP calculations are based on billing descriptors within each processing account. Most merchants find this piece of the puzzle confusing, especially with the rise in dynamic descriptors, where each transaction has a different billing descriptor. We are reaching out to Visa Global Risk to receive clarity around how Visa is tracking disputes when it comes to calculating VAMP.

What are the new risk thresholds?

First and foremost, Visa only informed the new VAMP risk thresholds to processors. However, thanks to our processor relationships, we confirmed that processors need to maintain a VAMP ratio below 0.5%. This ratio is nearly 30% lower than the prior threshold of 0.7%, which was when processors would flag merchants for risk. This means processors will become less tolerant of merchants with elevated chargeback rates in order to avoid fines from Visa.

Interestingly, the VAMP ratio for merchants is 2.2% until April 2026, when it will drop to 1.5%. Also, merchants need to exceed 1,500 (previously 1,000) combined fraud and non-fraud dispute count and exceed the VAMP ratio to be flagged by Visa. The VAMP count and ratio seem manageable at first glance, but for low AOV subscription merchants, it is a disaster waiting to happen.

Prior to VAMP, there was VDMP which tracked TC15 disputes and VFMP which tracked TC40 disputes. Merchants handled VDMP with RDR pre-dispute alerts and rarely exceeded the VFMP threshold of $75,000 in monthly fraud-related disputes. However, consider a scenario where a merchant has $30,000 in monthly fraud-related disputes; this is well below VFMP thresholds. However, if the merchant's AOV is $10.00, that means the merchant receives 3,000 fraud-related disputes per month, which is well above the 1,000 total dispute count threshold under VAMP. Low AOV merchants processing high volumes need to be prepared for VAMP as soon as possible.

What solutions are available?

Digital receipts is new-and-coming solution that may be able to reduce fraud-related disputes by 10 - 15%. This solution provides consumers with additional transaction info within their banking apps, including SKU-level descriptions, location information and customer support resources. These clarifying details deter consumers from filing a dispute out of confusion.

Ethoca and CDRN pre-dispute alerts can reduce 5 - 10% of fraud-related disputes. This is because some issuers do not log these fraud-related disputes in their TC40 reports when resolved through Ethoca and CDRN pre-dispute alerts.

Embedded subscription management is an exclusive Chargeblast solution that can likely reduce 15 - 20% of fraud-related disputes as it provides consumers an option to cancel their subscriptions and/or request for a refund within their banking apps, providing an alternative option to disputing the transaction.

What next?

There is not a one-size fits all solution for merchants preparing for VAMP. It is important to get in touch with risk experts who are well connected to the payment networks and have a full understanding of whether merchants fit the criteria for adopting one of the aforementioned solutions or not. Chargeblast's founders are available around the clock to make sure your organization and livelihood are secured during this time of change. Leave us some details below and we will be in touch!