What is Visa's Rapid Dispute Resolution (RDR) and how can it help merchants selling on Stripe and other processors reduce their chargeback rate?

What is RDR?

RDR is a dispute resolution system that any acquiring bank accepting Visa cards is mandated to use. It is an updated version of Visa's legacy Cardholder Dispute Resolution Network (CDRN). In 2020, RDR replaced CDRN as Visa's preferred way for merchants to stop disputes back.

RDR gives merchants the opportunity to refund disputed transactions before they hit the processing account. Because RDR is an acquiring side product, the refund is handled by the processing account (for example Stripe or Adyen's bank) not by you. No action is required on by the merchant to process these refunds.

Additionally, because RDR is built on top of tech that is mandated by banks accepting Visa, if you fully deploy RDR you will deflect 100% of Visa chargebacks.

How does it work?

To understand how RDR works, you must first have a basic understanding of how a chargeback is generated. When a consumer contacts their bank to dispute a purchase, their bank will log the dispute. That dispute propogates through the banking and system and eventually hits the merchant's bank (also known as the acquiring bank). This will typically happen 7 days business days after the cardholder called their bank.

When the dispute hits the merchant bank, if it is a Visa charge, the acquiring bank will check to see if the merchant is enrolled in RDR. If so, the transaction will be auto-refunded before it becomes an official dispute.

What this means, is for any merchant that turns on RDR, all of their Visa chargebacks will be auto-refunded, thereby nullifying any dispute rate hike or other penalties that come with disputes (e.g. dispute fees and contributions to VDMP).

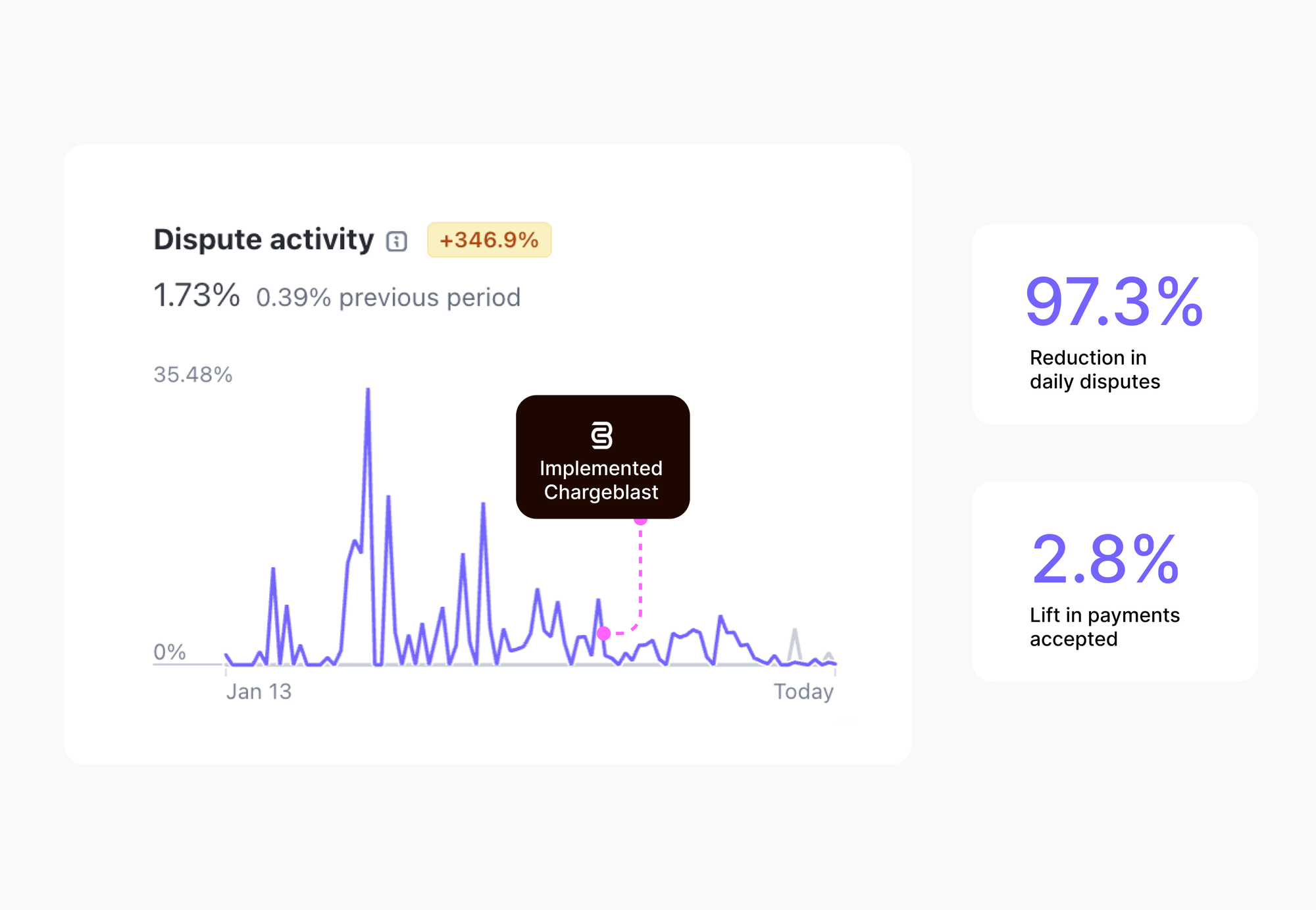

What results can we expect?

If you set up RDR with a ruleset of refund everything every dispute on Visa will turn into a refund. As a result, your dispute rate will drop by the percent of Visa transactions you accept. In the US the average rate of Visa transactions is 65%, so your dispute rate would be reduced by 65% just by turning on RDR.

For many merchant mid risk merchants (dispute rates in the .5-1.2% range), just turning on RDR alone can be completely sufficient for ever having to worry about a dispute rate problem.

Are there any downsides to enabling RDR?

There are a few downsides to turning on RDR, and RDR is not the best for every merchant.

Unlike other alerting products, you will not have any control over which disputes are refunded and which ones pass through (other than setting up a dollar amount rule beforehand). For this reason, there are a few categories of merchants who would not be a good fit for RDR:

- Merchants with high average sale prices. For these merchants, going to chargeback re-presentment makes more sense.

- Merchants with low dispute rates, high rates of friendly fraud and high win-rates. If you have a dispute rate in the 0.0-0.2% range, it and have a high win-rate during re-presentment (50%+) it does not make sense to use RDR.

Merchants that are good fits for RDR:

- Merchants with low average sale prices.

- Merchants with medium to high dispute rates.

- Merchants with low risk MCC codes (you will print savings on RDR alert fees vs dispute fees).

How much does it cost?

The cost for RDR varies depending on the merchant's MCC code. For riskier merchants, RDR is more expensive. The majority (90%) of Stripe merchants are T2:

| Tier | Price | MCCs | Example Merchants |

|---|---|---|---|

| 1 | $5 | Low risk | Retail Store |

| 2 | $19 | Medium risk | Subscription Software, Digital Goods |

| 3 | $29 | High risk | Adult, Online Gambling, CBD |

How do you get set up?

You can get set up with RDR via Chargeblast. Just register for an account here (takes 5 minutes)!